Two of the Largest Bank Failures in History Happened This Week - Here's Why

Before I begin, I’d like to make it known that I am in no way an expert in the worlds of finance, economics, or money markets. As a technologist, the recent collapse of Silicon Valley Bank and Signature Bank has sent shockwaves through our community. While I may not be an expert in these fields, the implications of this event cannot be ignored. In this article, I aim to provide a comprehensive breakdown of the events leading up to the collapse, as well as offer insights into what this means for our community. Whether you're a startup founder, a venture capitalist, developer or simply someone with an interest in the tech industry, the fallout from this incident will undoubtedly have a serious ripple effect. Let’s take a look at what happened.

Let's start with the facts: Three major banks in the US failed in a short span of time - Silvergate, Signature Bank, and Silicon Valley Bank. While Silvergate was the smallest, holding about $11 billion in total assets, Signature Bank was a mid-sized bank with just over $110 billion in assets, and Silicon Valley Bank was the largest with about $209 billion in assets. Both Silvergate and Signature Bank were well-known in the crypto-currency space, while Silicon Valley Bank was a significant player in the start-up world. Despite their differences, however, these banks all failed for similar reasons at a high level.

All three of these banks have faced a "run on the bank," meaning that a large number of customers were demanding to withdraw significant amounts of money at an unsustainable rate. Unfortunately, the banks did not have sufficient funds available to cover these withdrawals, resulting in a cash shortage.

Many have drawn comparisons between these events and the crypto crash of 2022, which saw companies like FTX collapsing. However, this comparison falls short because the crucial difference lies in the fact that companies like FTX were insolvent, not illiquid. This means that when there was a run on FTX, they had no funds to offer for withdraws. On the other hand, when there was a run on the banks mentioned above, they had some funds available, but most of their assets were tied up in long-term investments like treasury bonds. While liquidity and insolvency are not the same thing, a bank run can quickly transform a liquidity problem into an insolvency problem, especially when a bank needs to liquidate its bonds or other investments for immediate cash.

As a further explanation, it’s widely known that one of the safest investments is treasury bonds. My father (and most likely your father) has told me this time and time again. Treasury bonds are notorious for providing a stable rate of return. As of March 14, 2023, the yield on 10 year Treasury bonds is approximately 1.3%, while the yield on 30 year Treasury bonds is around 1.9%.

Imagine you are Signature Bank. You have billions of dollars in customer assets, and you want to keep them secure while also generating modest returns. So, where do you invest? Treasury bonds, of course. You keep some cash on hand for regular withdrawals, and rely on selling bonds in case of an emergency. However, what happens if interest rates suddenly skyrocket? The 10-year bond you bought last year that had a 1% yield now pales in comparison to the 5% yield offered on the same 10-year bond by the government. Your bond loses significant value in the open market and is not even worth the purchase price. Selling it would result in a loss, and as a bank, you hate losing money more than anything else. Add to that the pressure from depositors who are demanding their funds, and holding onto these bonds is no longer a viable option.

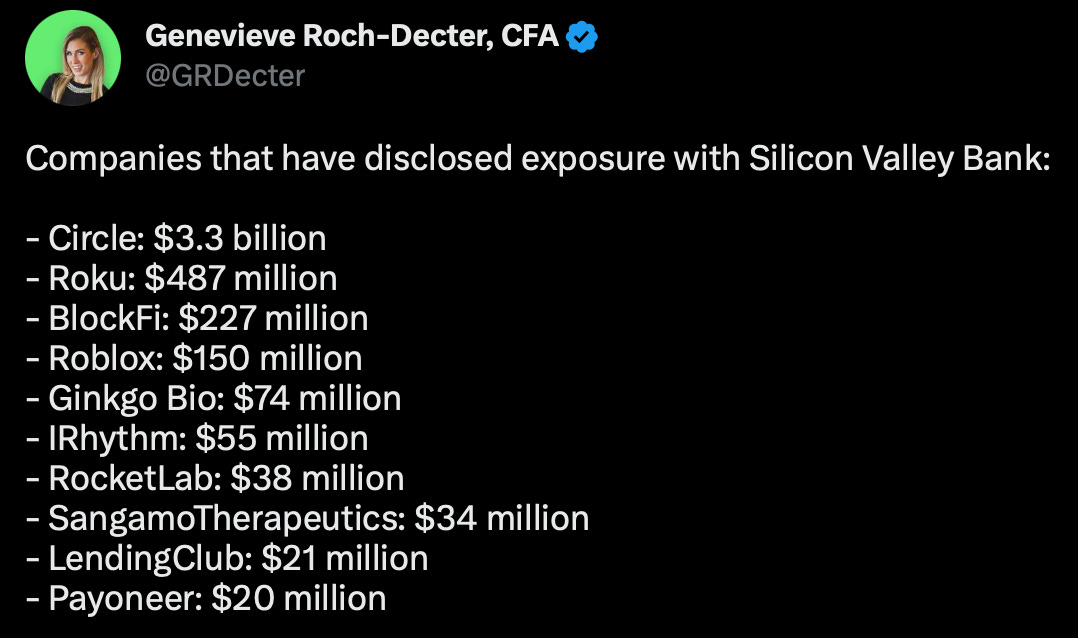

This is exactly what unfolded with Silicon Valley Bank, Signature Bank, and Silvergate, among others. As these banks were compelled to sell their treasury bonds to meet the demands of depositors, they incurred some serious losses. Consequently, like I said before, what started as a liquidity crisis quickly escalated into an insolvency crisis, ultimately culminating in the banks closure. Despite the government insuring bank deposits of up to $250,000 per account, Silicon Valley Bank held numerous accounts with significantly higher amounts. Hosting venture capitalists, startups, and more, the bank found itself unable to accommodate the vast number of withdrawal requests. Consequently, the affected companies suddenly found themselves unable to access their funds. Here is a picture showing the companies with money tied up in Silicon Valley Bank.

Wow … that’s a lot of money.

This triggered a visceral response from those in Silicon Valley, calling on the likes of Jerome Powell and Janet Yellen to guarantee depositors all of their money. This sparked a lively debate over whether or not the government would or should get involved.

Ultimately, the US Department of the Treasury came out and said “Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.” So, the government has officially stepped in to save not just Silicon Valley Bank, but a hand full of other collapsed banks.

The events of this week will have a profound effect on the technology industry, particularly the startup world. These collapses will most likely lead to a tightening of credit, making it more difficult for startups and emerging technology companies to secure financing and investment. This is because investors will be more hesitant to provide funding, given the increased risk of bank failures and their impact on the broader financial system. The collapse of these banks may also result in a loss of confidence in the startup ecosystem, particularly in the Silicon Valley region, which has long been a hub for innovative technology companies.

Although this may seem like a different topic than what we usually cover here at Safe<br>Space, the ramifications of these collapses are significant for the technology community. As the situation continues to develop, we will be sure to provide you with the latest updates and insights. Stay tuned!